Firm News

Keane Group Launches Initial Public Offering

January 20, 2017

Schulte has advised Keane Group Inc. on the company’s initial public offering of 26.7 million shares of its common stock. The Keane IPO, the first completed in 2017, is notable in that the size of the offering was increased twice and priced at $19, at the high end of the range. Keane, one of the largest pure-play providers of integrated well-completion services in the United States, is listed on the New York Stock Exchange.

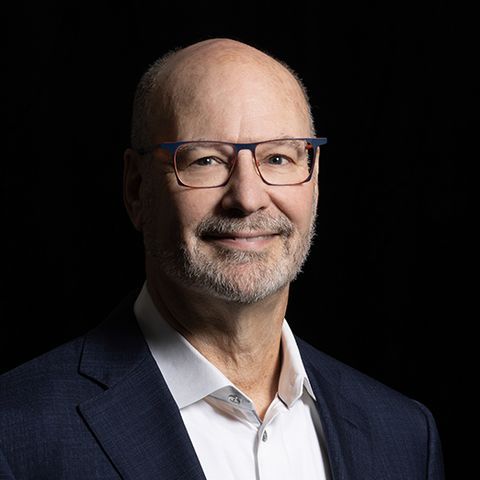

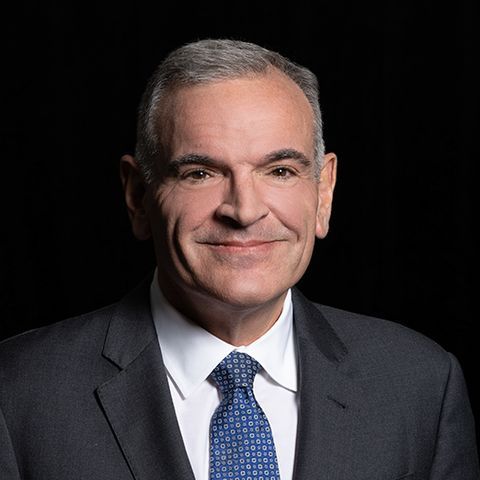

The Schulte team representing Keane is led by M&A and securities partner Stuart Freedman, with assistance from employment & employee benefits partner Ian Levin and former Schulte lawyers Antonio Diaz-Albertini and Kurt Rosell.